Created in the Tax Cuts and Jobs Act of 2017, Opportunity Zones is a federal program that provides tax incentives for investments in new businesses and commercial projects in low-income communities. On April 2018, Mayor Bowser nominated 25 census tracts to be Opportunity Zones. The U.S. Department of Treasury certified these tracts on May 18, 2018

DC's Opportunity Zones

- View an interactive map of designated census tracts.

- Download a pdf map of designated census tracts.

- Download the excel spreadsheet of designated census tracts.

- Click here to read about how the District designated Opportunity Zones.

- OZmarketplace.dc.gov includes listings of investment opportunities in DC Opportunity Zones and other resources.

- The Advisory Neighborhood Commissioner interactive map enables users to find ANC commissioners representing communities in Opportunity Zones.

Desired Outcomes of Opportunity Zone Investment in DC

The District views the OZ incentive as a tool that can be leveraged to support public and community economic growth priorities. DMPED is focused on aligning OZ investments with community priorities, supporting community-driven projects seeking investment, and maximizing benefits to existing residents, businesses and organizations located in the District’s OZs. The District’s priorities for OZ investment include:

- Deliver new, neighborhood-serving amenities, such as retail and fresh food grocers

- Provide investment capital and growth opportunities for DC small businesses, particularly those led by underrepresented entrepreneurs

- Create jobs for DC residents and pathways to the middle class

- Increase affordable and workforce housing

- If you represent a Qualified Opportunity Fund seeking to invest in these areas, contact Moises Del’Rosario at [email protected].

If you have a project that addresses these priorities in DC’s Opportunity Zones and is seeking investment from a Qualified Opportunity Fund, submit it at OZmarketplace.dc.gov.

District of Columbia Qualified Opportunity Fund (DC-QOF) Process

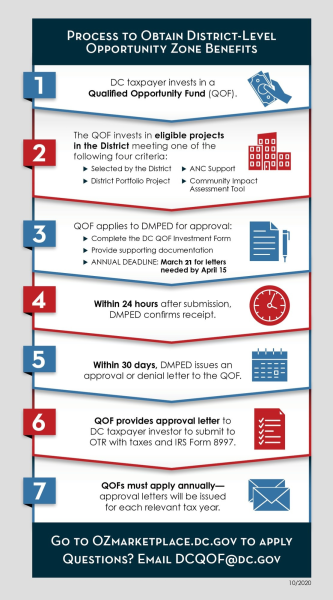

Opportunity Zones is a federal tax incentive, and the benefits are applied to federal capital gains taxes. The District of Columbia also taxes capital gains. Per D.C. Act 23-407 Section 2021, District taxpayers can realize Opportunity Zones tax benefits at the District level for qualifying investments made by QOFs approved by the Mayor.

View guidance on the DC QOF approval process and how DC taxpayers can obtain the Opportunity Zones tax benefits at the District level here.

Capital for Communities Scorecard

The District offers various incentives that OZ projects can take advantage of. Visit https://www.urban.org/C4CScorecard for details.

More Opportunity Zones Resources

IRS:OZ Frequently Asked Questions

IRS: Press Release on Proposed Regulations

Department of Treasury Press Release on Proposed Regulations

CDFI Fund: Opportunity Zone Resources

Enterprise: Opportunity Zones

Economic Innovation Group: Opportunity Zones

Opportunity Zones: Maximizing Return on Public Investment (Urban Institute)

Beeck Center at Georgetown University OZ Impact Reporting Framework

Opportunity Zones Incubator (Kresge Foundation, Calvert Impact Capital)

Novogradac: Opportunity Zone Resource Center

The Opportunity Exchange

Final Opportunity Zones Regulations

“The Substance and Significance of the Final Regulations on Opportunity Zones” (Economic Innovation Group, Steptoe & Johnson LLP, Novogradac & Company LLP (1/14/2020)

Final Opportunity Zones Regulations (12/19/2019)

U.S. Treasury Department/IRS FAQ on Final Opportunity Zones Regulations (12/19/219)

Final OZ Regulations — Quick Take (12/19/2019, Novogradac)

Listings of Qualified Opportunity Funds: